Stocks recently posted their best week all year: where did all the market volatility go?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — August 20, 2024

Stocks rebounded last week and posted their best week of the year. Volatility continued to sink lower from extremely elevated levels at the beginning of the month following tamer-than-expected inflation reports and economic releases that keep a soft landing on the table. And while earnings reports from some big box retailers were mixed last week, overall, second quarter S&P 500 earnings per share (EPS) growth is set to record its best quarter of profits since the fourth quarter of 2021.

Last Week in Review:

-

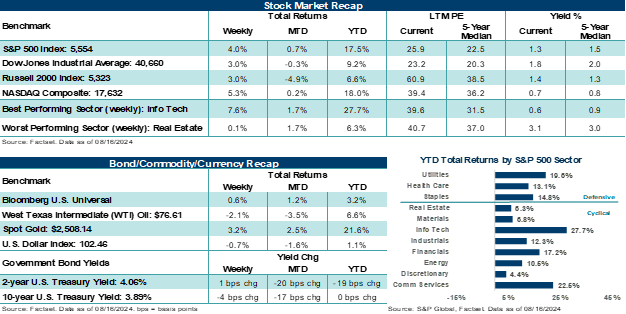

The S&P 500 Index gained roughly +4.0%, while the NASDAQ Composite jumped +5.3%. Both stock benchmarks broke four straight weeks of declines and posted their best weekly performance since November 2023.

-

After recently surging to levels last seen since the pandemic, the CBOE VIX Index (a measure of stock volatility within the S&P 500) finished the week essentially back at its one-year average. The quick decline in stock volatility is partly a result of investors buying the dip after swift and aggressive selling pressure in early August.

“It's mid-August, and we are in a seasonally weak period for stocks. Volatility usually climbs in August and September, and an upcoming election in November may keep markets wound tight and susceptible to periodic downdrafts.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- Investors drove Information Technology (+7.5%) and Consumer Discretionary (+5.2%) higher, with NVIDIA (+18.9%) and Tesla (+8.1%) doing some of the heavy lifting in each index. Notably, all eleven S&P 500 sectors finished higher.

- Both the Dow Jones Industrials Average and Russell 2000 Index ended higher by roughly +3.0%.

- July updates on consumer and producer price inflation showed continued moderation toward normalized levels. For example, the headline Consumer Price Index (CPI) stood at +2.9% year-over-year at the end of July, while core CPI (ex-food and energy) ended last month at +3.2%. Notably, the three-month annualized rate of core CPI now stands at just +1.57 % (the slowest pace since February 2021), while the six-month annualized rate stands at +2.84% (the lowest level since March 2021). Shelter costs remain the last sticky component of elevated CPI.

- Weekly jobless claims came in weaker-than-expected, returning to early July levels. Updates on the consumer showed healthy levels of spending across July retail sales, while a preliminary look at August Michigan Sentiment came in ahead of estimates, with inflation expectations unchanged from July. Earnings reports from Home Depot and Walmart showed delayed interest in home improvement projects (due to higher interest rates) but a stable/discerning consumer when it comes to general merchandise/grocery purchases.

- Bottom line: Continued progress on inflation, moderating but still healthy labor conditions, and economic updates that point to firm consumer trends likely allow the Federal Reserve to comfortably begin cutting its policy rate in September.

- U.S. Treasury yields were largely flat on the week. However, with inflation ebbing lower, a little more caution among investors, and roughly 100% odds of a rate cut next month, both 2-year and 10-year yields are down month-to-date.

- Gold added over +3.0%, finishing Friday at a fresh all-time high. The U.S. Dollar Index ended higher. And West Texas Intermediate (WTI) crude moved lower.

Where did all the volatility go?

Last week, we made the point that the occasional storm shower can help reset the deck chairs (i.e., create better entry points for investors looking to put cash to work in the stock market). Well, based on recent performance, either the storm clouds have passed, or investors are ignoring potential forming clouds over the horizon. The S&P 500 is just 2.0% away from its mid-July high, the Dow is less than 2.0% away from its high-water mark, and the NASDAQ is roughly 5.5% away from its July top. So, what's changed from the world could be coming to an end at the start of August to everything is hunky dory again — buy the dip. The short answer is not much. If anything, the spike in volatility this month, including aggressive selling and buying, should communicate how tightly wound markets are given current valuations in the major averages, particularly as it pertains to macroeconomic conditions and the path for interest rate policy.

Yet, since the July highs, technical conditions across several of the major U.S. stock averages have improved after a period of overbought conditions. For instance, the S&P 500's recent dip below its 50-day and 100-day moving averages at the same time (something that hasn't occurred since the October 2023 lows) posed an opportunity for professional traders to seize on the near-term buying opportunity. Further, buy the dip apparently is alive and well among several types of investors, as a record $6.2 trillion sits in money market funds. Stock declines since mid-July, compounded with the unexpected spike in volatility earlier this month, allowed investors of all types the opportunity to take advantage of the declines and put excess cash to work in areas they may have felt got away from them in their run-up during the first half.

From a monetary policy perspective, whether it's a 25 or 50-basis point cut next month isn't really that important. What is important, and not lost on investors over the last week or so, is that updates on labor, services activity, inflation, and the consumer all point to a still healthy economic environment, but one that allows the Fed room to start easing monetary policy. This is how a soft landing starts, in our view. Of course, there is no guarantee the Fed will ultimately pull it off, but you need the conditions in place to start, and it looks like we finally have those conditions in place today.

Bottom line: It's mid-August, and we are in a seasonally weak period for stocks. Volatility usually climbs in August and September, and an upcoming election in November may keep markets wound tight and susceptible to periodic downdrafts. Moving forward, most long-term investors should maintain a well-diversified portfolio, have a plan to put excess cash to work in the market (potentially systematically), and avoid getting rattled by what could be additional bouts of market volatility through the end of summer and into the fall. And if that potential volatility doesn't come to pass, then take comfort in knowing your well-diversified portfolio is holding its own and participating in a more stable market environment. Either way, you have a plan to address evolving conditions.

The Week Ahead:

The Democratic National Convention, the Fed's annual Jackson Hole Economic Symposium, July FOMC meeting minutes, preliminary looks at manufacturing/services activity, home data, and second quarter earnings reports from a batch of retailers line the calendar.

- On Monday, the Democratic National Convention will kick off In Chicago. Vice President Kamala Haris is expected to formally accept the Democratic presidential nomination on Thursday, and her running mate, Minnesota Governor Tim Walz, is scheduled to speak at the convention on Wednesday. In her speech, Harris is expected to lay out her vision for the country over the next four years. She has recently announced economic proposals that would enforce limits on grocery store profits, expand tax cuts for lower-income Americans, push to eliminate federally backed student debt, and offer new tax credits for first-time home buyers. However, details on these proposals have thus far been light, and how she plans to pay for them without further ballooning U.S. deficits and/or debt burdens remains unclear.

- Central bankers and economists from around the world will converge in Jackson Hole, Wyoming, this week for the Federal Reserve's annual Economic Policy Symposium. The gathering will take place from August 22nd through 24th and is titled "Reassessing the Effectiveness and Transmission of Monetary Policy." However, most investors will be focused on Fed Chair Powell's Friday address at the forum. Investors should expect Mr. Powell to lay the groundwork for a September rate cut but remain attentive to the Fed's growing focus on balance between its dual mandate of price stability (i.e., inflation) and full employment.

- While economic releases will be light, investors will get a chance to see the minutes from the last Fed meeting. However, this release should have less impact on the market, given Powell's key speech on Friday. Home data this week is expected to show a bounce from weaker levels the previous month, and August looks at economic activity should show continued moderation.

Earnings reports from Lowe's Companies (Tuesday), Target Corp. (Wednesday), and Ross Stores (Thursday) will again offer a window into important consumer trends/outlooks.